File Form 2290 Online & Get Your Stamped Schedule 1 in Minutes!

- IRS Authorized

- Quick Processing

- Instant error check

- Free VIN Corrections

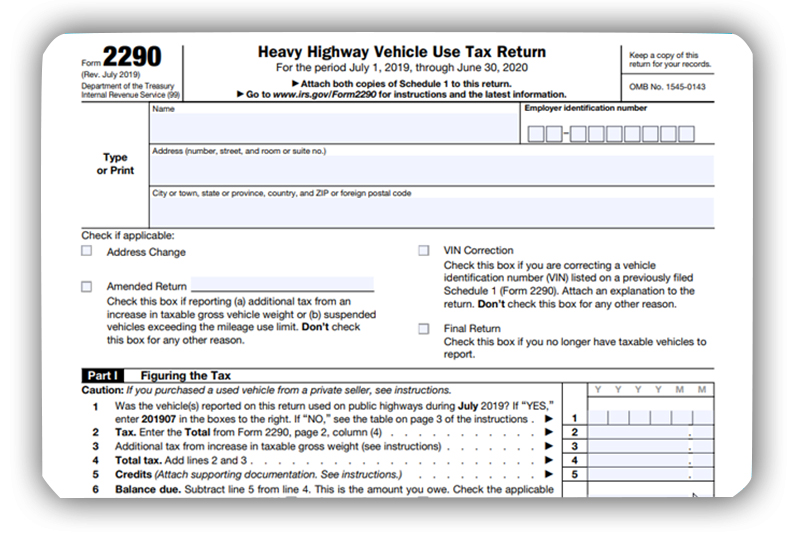

IRS Form 2290 Overview

Form 2290 is used by the IRS to collect heavy vehicle use taxes from those who operate heavy vehicles on public roads. If your vehicle weighs 55,000 pounds or more you must File Form 2290 online on an annual basis. The taxes collected from 2290 Form are used to build, repair, and maintain public highways.

By completing form 2290 you will get a copy of your schedule 1 which serves as proof of form 2290 online filing. This is actually required by most trucking companies to prove that you comply with truck tax laws.

If you don’t have an EIN, apply for one with the IRS online because your 2290 form will be rejected if you don't have an EIN.

Vist https://www.expresstrucktax.com/ efile/irs2290/ to learn more about IRS Form 2290

When is the Due Date to File Form 2290?

If you put a new truck on the road during a given tax year, your Form 2290 deadline is based on the vehicle's month of first use. In this case, your deadline will be the end of the month following the month of first use. For instance, if you started using a truck in January, your Form 2290 deadline will be February 28 (unless the end of the month falls on a weekend, then your deadline will be the next business day).

However, if you are still using the same truck as the last tax year, your Form 2290 deadline will be August 31 of each year.

Vist https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to learn more about IRS Form 2290 Deadline

File Form 2290 NowInformation Required to File Form 2290 Online

In order to file form 2290 online, you need to provide your business information, such as your name, address, and EIN (Employer Identification Number). If you don’t have an EIN apply for one with the IRS online because your 2290 form will be rejected without it. You will also need your HVUT tax year and first use month.

For your vehicle(s), you will need to provide the taxable gross weight and VIN or Vehicle Identification Number. You will also need to specify on your HVUT Form 2290 if your vehicle was used for any special purposes, such as logging or agricultural use.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-instructions/ to learn more about Form 2290 Instructions

File Form 2290 NowHow to File Form 2290 Electronically?

Only 3 Simple Steps to get your 2290 Schedule 1

Enter your Form 2290 Information

Review and Transmit to the IRS

Get Your Stamped Schedule 1

Starts at $9.90 for a single truck

What are the IRS Form 2290 Penalties and Interest for Late Filing?

- The IRS will impose several fees for not filing your Form 2290 by the deadline. These include:

- A penalty of 4.5% of the total tax due, added monthly for up to five months.

- A monthly penalty of 0.5% of the total tax due for underpayment of HVUT.

- Additional interest charges of 0.54% per month accrue

Visit https://www.expresstrucktax.com/hvut/form-2290-penalties/ to learn more about IRS Form 2290 penalties

File Form 2290 NowStarts at $9.90 for a single truck

Features

Frequently Asked Questions

Anyone who owns or operate a highway vehicle with the gross weight of 55,000 pounds or more are need to file Form 2290 to the IRS. Read more....

While filing your IRS Form 2290 the vehicle must be filed in the name of the vehicle registered owner name. Read more...

Now, the IRS Started the credit and debit card payment option. Taxpayers can pay their HVUT taxes by using debit and credit cards

Form 2290 filers can pay their HVUT using any of the following options.

- The IRS will impose several fees for not filing your Form 2290 by the deadline. These include:

- Electronic Funds Withdrawal (EFW)

- Electronic Federal Tax Payment System (EFTPS)

- Check or Money Order

- Credit/Debit Card

Visit, https://www.expresstrucktax.com/hvut/irs-2290-hvut-payment/ to learn more about HVUT payment options

Ready to File Form 2290 for the 2021-2022 Tax Period?

File Form 2290 NowHelpful Free Tools to Keep Your Trucking Business Moving

HVUT Tax Calculator

Take the guesswork out of estimating your taxes with ExpressTruckTax’s Free HVUT Calculator. Quickly figure out your 2290 tax amount and know how much your HVUT will be.

IFTA Tax Calculator

Make your IFTA reporting hassle-free with our free IFTA calculator. Calculate your IFTA taxes online. Simple, easy, and accurate. Trusted by owner-operators like you.

Pricing to File Form 2290 Online

Owner Operator

$9.90Single Vehicle

Small Fleet

$29.952 to 24 Vehicle

Medium Fleet

$59.9525 to 100 Vehicle

Easily File Form 2290 Online Using Our Mobile Device

Enjoy the freedom to file Form 2290 online at any time from any location with our Form 2290 mobile app. Our mobile app can be used on any iOS and Android devices. Enjoy the same great filing experience with our mobile app.